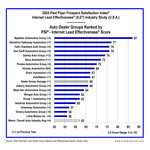

- Eighteen Auto Dealer Groups Measured: Berkshire Hathaway ranked second, Herb Chambers and Ken Garff tied for third

MONTEREY, Calif.–(BUSINESS WIRE)–Napleton Auto Group dealerships were ranked highest out of eighteen of the largest auto dealer groups for the third year in a row according to the 2024 Pied Piper PSI® Internet Lead Effectiveness® (ILE®) Study, which measured responsiveness to internet leads coming though dealer websites. Following Napleton were Berkshire Hathaway, Herb Chambers, Ken Garff, and Ganley dealer groups.

Pied Piper submitted mystery-shopper customer inquiries to all dealerships owned by each of the eighteen dealer groups, asking a specific question about a vehicle in inventory, and providing a unique customer name, email address and local telephone number. Pied Piper then evaluated how the dealerships responded by email, telephone, and text message over the next 24 hours. ILE evaluation of a dealership combines over 20 different measurements to create a total score ranging between 0 and 100.

In this year’s study, 42% of dealerships scored above 80, providing a quick and thorough personal response, while 18% scored below 40, failing to personally respond to their website customers. Napleton, the top performing dealer group, significantly outperformed the industry average, with 84% of their dealerships scoring over 80, and only 6% scoring less than 40. “Top performing dealerships focus on their behaviors, but they also carefully track what their website customers are really experiencing – which is often a surprise,” said Fran O’Hagan, CEO of Pied Piper. “Without this step, dealership reports can encourage employees to pretend to respond, with automated responses to quickly ‘stop the clock,’ instead of the personal replies needed by customers.”

Dealer groups with the greatest improvement were Ganley Automotive Group, Serra Automotive Inc. and Berkshire Hathaway Automotive. Meanwhile, the performance of Hendrick Automotive Group, Penske Automotive Group, Morgan Auto Group, and Victory Automotive Group declined three or more points from last year’s scores.

The dealer group industry average ILE score rose to 66 this year, a one point improvement over the past year and four points higher than the 2024 ILE average score for the overall auto industry. The most notable behaviors driving improvement were dealers responding quicker to online customers by phone call, as well increased use of multiple communication channels (phone, email, text) to respond to a customer. Napleton Automotive Group improved in the same key areas as the rest of the industry, but further improved in other areas including attempting to schedule an appointment, and answering more questions by text message.

Compared to the automotive industry overall, the large dealer groups tend to respond to website customers quicker and more thoroughly. In this year’s study, fourteen of the eighteen dealer groups measured scored at or above the 2024 ILE average score for the overall auto industry. Conversely, for the overall auto industry, only four of the 37 automotive brands measured achieved 2024 ILE average scores above the dealer group industry average.

Response to customer web inquiries varied by dealer group and dealership, and the following are examples of performance variation by dealer group:

-

How often did the group’s dealerships email an answer to a website customer’s inquiry?

- More than 75% of the time on average: Napleton AG, Herb Chambers, Serra Automotive

- Less than 50% of the time on average: Lithia Motors, Hendrick AG, Victory AG

-

Dealer group industry average: 58%

-

How often did the group’s dealerships text an answer to a website customer’s inquiry?

- More than 50% of the time on average: Ken Garff AG, Napleton AG, Holman Automotive

- Less than 25% of the time on average: Serra Automotive, Herb Chambers AG, West Herr AG

-

Dealer group industry average: 36%

-

How often did the group’s dealerships respond by phone call to a website customer’s inquiry?

- More than 85% of the time on average: Napleton AG, Berkshire Hathaway, Ken Garff AG, Ganley AG

- Less than 50% of the time on average: West Herr AG, Victory AG

-

Dealer group industry average: 69%

-

“Did both” – How often did the group’s dealerships email or text an answer to a website customer’s question and also respond by phone call?

- More than 70% of the time on average: Napleton AG, Herb Chambers AG, Ken Garff AG

- Less than 40% of the time on average: West Herr AG, Greenway Automotive, Victory AG

-

Dealer group industry average: 51%

-

“Did both fast” – How often did the brand’s dealerships email or text an answer to a website customer’s question and also respond by phone call all within 30 minutes of submitting an inquiry?

- More than 50% of the time on average: Napleton AG, Herb Chambers AG, Ganley AG

- Less than 25% of the time on average: Victory AG, Lithia Motors, AutoNation, Greenway Automotive

- Dealer group industry average: 34%

Pied Piper PSI® Internet Lead Effectiveness® (ILE®) Studies have been conducted annually since 2011 for the auto industry and other industries. The 2024 Pied Piper PSI® Internet Lead Effectiveness® (ILE®) Auto Dealer Group Study was conducted between August 2023 and February 2024 by submitting 1,535 website inquiries to all of the dealerships owned by eighteen of the largest automotive dealer groups.

About Pied Piper Management Company, LLC

Founded in 2003, Pied Piper Management Company, LLC is a Monterey, California, company that helps improve the omnichannel sales & service performance of retailers, by determining fact-based best practices, then measuring and reporting performance. Examples of other recent Pied Piper PSI studies are the 2024 Pied Piper PSI® ILE® Auto Industry Study (Nissan’s Infiniti brand ranked first), 2024 Pied Piper PSI® ILE® Powersports Industry Study (Polaris Inc’s Indian Motorcycle brand was ranked first), and the 2023 Pied Piper STE® Service Telephone Effectiveness® (STE®) Auto Dealer Group Study (Group 1 Automotive was ranked first). Complete Pied Piper PSI industry study results are provided to vehicle manufacturers and national dealer groups. Manufacturers, national dealer groups and individual dealerships also order PSI evaluations – in-person, internet or telephone – as tools to measure and improve the omnichannel sales and service effectiveness of their dealerships. For more information about the Pied Piper Prospect Satisfaction Index, and the fact-based PSI process, go to www.piedpiperpsi.com.

This press release is provided for editorial use only, and information contained in this release may not be used for advertising or otherwise promoting brands mentioned in this release without specific, written permission from Pied Piper Management Co., LLC.

Contacts

Pied Piper

Ryan Scott

(831) 648-1075

rscott@piedpipermc.com