- Boat industry’s first measurement & ranking by Pied Piper’s Telephone Lead Effectiveness™

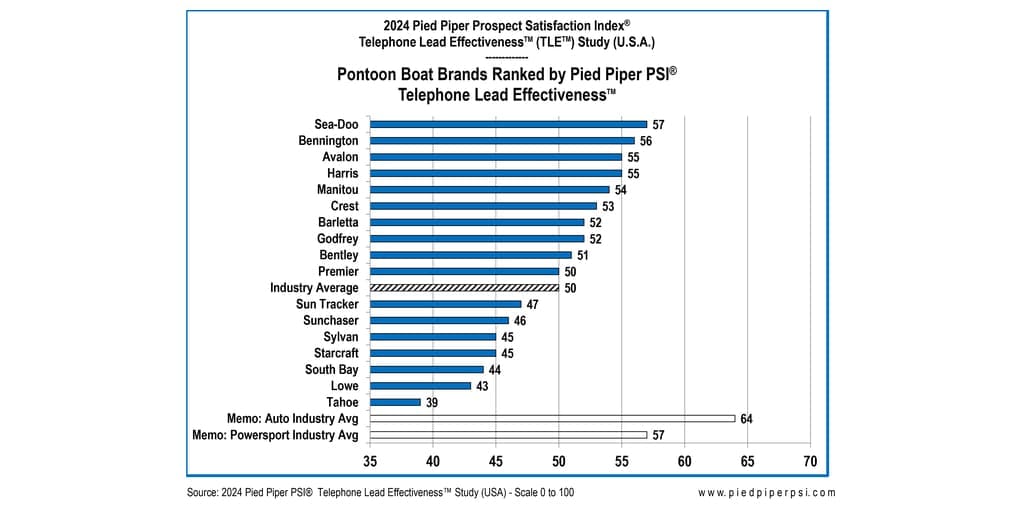

MONTEREY, Calif.–(BUSINESS WIRE)–BRP Inc’s Sea-Doo dealerships were ranked highest according to the 2024 Pied Piper PSI® Telephone Lead Effectiveness™ (TLE™) Study, which measured responsiveness to sales customers who phoned boat dealerships interested in purchasing a pontoon boat. Following Sea-Doo were dealerships selling Polaris Inc’s Bennington, Avalon & Tahoe Manufacturing’s Avalon, and Brunswick Corporation’s Harris.

For more than fifteen years Pied Piper has provided measurement and reporting of best practice sales and service behaviors using the fact-based Prospect Satisfaction Index® (PSI®) process. Brands from industries such as automotive, powersports and agriculture have been measured and ranked, but 2024 marks the first PSI® industry study for the marine industry, focusing on brands and dealerships selling the industry’s most popular product: pontoon boats.

Telephone Lead Effectiveness™ (TLE™) measures what happens when a sales customer interested in purchasing a product phones a dealership. How effectively does the dealership answer the call, provide the help the customer desires, and encourage the customer on their path to visiting the dealership and becoming a buyer? To complete the study, Pied Piper anonymously phoned 802 dealerships between March 2024 and September 2024, at locations representing the seventeen largest pontoon boat brands.

“One out of four buyers today first contacts a dealership by telephone,” said Fran O’Hagan, Pied Piper’s CEO. “That phone interaction is critical to whether a customer visits a dealership and purchases a boat, but too often telephone processes and behaviors are invisible to dealership management.”

Twenty-five different quality and speed of response measurements generate dealership TLE scores, which range from zero to 100. Dealerships which score above 70 provide a quick, helpful and complete interaction. In contrast, dealerships which score below 40 fail to answer the call, or fail to answer the customer’s question and fail to suggest an appointment or encourage a visit the dealership. Dealers representing top scoring brands were twice as likely on average to score over 70, and half as likely on average to score under 40, compared to dealers from poor performing brands.

Each brand’s TLE average score is determined by compiling measurements from the brand’s individual dealerships. The following are examples of how each brand’s average customer experience varied:

-

Mission Excellent – Quick response, helpful and complete interaction – Achieved TLE score over 70

- Occurred more than 20% of the time on average: Harris, Crest, Godfrey

- Occurred less than 7% of the time on average: Sun Tracker, South Bay, Premier, Tahoe

-

Mission Acceptable – Reached salesperson in <1 minute, answered question, offered appointment

- Occurred more than 75% of the time on average: Avalon, Manitou, Sea-doo

- Occurred less than 60% of the time on average: Sunchaser, Sylvan, South Bay, Tahoe

-

Mission Failure – Call unanswered, or failed to answer customer’s question and also failed to offer appointment or encourage visit

- Occurred less than 5% of the time on average: Avalon, Barletta, Manitou, Sea-Doo

- Occurred more than 10% of the time on average: South Bay, Sylvan, Lowe, Starcraft, Tahoe

-

Salesperson had to ask others for help to answer customer’s question

- Occurred less than 2% of the time on average: Bentley, Crest, Avalon

- Occurred more than 15% of the time on average: Tahoe, Premier, Sun Tracker

-

Customer was offered an appointment to visit dealership

- Occurred more than 70% of the time on average: Bennington, Harris

- Occurred less than 50% of the time on average: Starcraft, Lowe, Tahoe

“Customers shopping for top performing pontoon boat brands were three times more likely on average to have an excellent phone interaction than customers shopping for poor performing brands,” said O’Hagan. “Boat shoppers today are too precious to risk losing over a poor telephone experience.” Pied Piper has found that the key to driving improvement in telephone interaction and in turn higher sales is showing dealers what their telephone customers are really experiencing – which is often a surprise.

About Pied Piper Management Company, LLC

Founded in 2003, Pied Piper Management Company, LLC is a Monterey, California, company that helps brands and dealer groups improve the omnichannel sales & service performance of their retailers. Prospect Satisfaction Index® (PSI®) applies data science analytics to determine the omnichannel sales and service best practices most likely to drive purchase and loyalty. PSI then uses a combination of artificial intelligence, machine learning and human actors to measure and report how effectively retail locations follow those best practices.

PSI studies have been conducted annually since 2007. Examples of other recent PSI studies are the 2024 PSI® Internet Lead Effectiveness® (ILE®) Auto Industry Study (Nissan’s Infiniti brand was ranked first), and the 2024 PSI® Service Telephone Effectiveness® (STE®) Powersport Industry Study (Triumph was ranked first).

Complete PSI industry study results are provided to vehicle manufacturers and national dealer groups. Manufacturers, dealer groups and individual dealerships also order PSI evaluations – internet, telephone or in-person – as tools to measure and improve the omnichannel sales and service effectiveness of their dealerships. For more information about the fact-based Prospect Satisfaction Index® process, go to www.piedpiperpsi.com.

This press release is provided for editorial use only, and information contained in this release may not be used for advertising or otherwise promoting brands mentioned in this release without specific, written permission from Pied Piper Management Co., LLC.

Contacts

Ryan Scott

Pied Piper

(831) 648-1075

press@piedpiperpsi.com