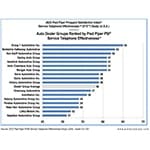

MONTEREY, Calif.–(BUSINESS WIRE)–Group 1 Automotive was ranked first of the seventeen largest U.S. auto dealer groups by the 2023 PSI® Service Telephone Effectiveness™ (STE™) Study, which measured the efficiency and quality of service telephone calls from a customer’s objective of quickly and easily setting up a service appointment. Following Group 1 in the rankings were Berkshire Hathaway Automotive and Ken Garff Automotive Group.

“Customers who find scheduling a service appointment difficult vote with their feet by moving to another dealership or independent shop, or postponing service,” said Fran O’Hagan, Pied Piper CEO. “The auto industry has long focused on the experience of customers who bring their vehicle in for service, but what really happens leading up to the appointment? STE fills-in that gap.”

The study was completed between January 2023 and May 2023, when Pied Piper phoned each of the 1,739 dealerships owned by the seventeen largest auto dealer groups, posing as a service customer attempting to schedule a service appointment. Overall STE scores range from 0 to 100, and are calculated from a mix of 39 individually weighted efficiency and quality data points that support the customer mission of quickly and easily setting up a service appointment for a specific date and time. 62% of the total score is determined by efficiency measurements, while 38% of the total score is determined by quality measurements.

Thirteen percent of the dealerships nationally achieved STE scores over 80, by providing an effective call that quickly and easily offered an appointment. In contrast, 20 percent of the dealerships nationally scored below 40, which represented a failed call that did not easily offer an appointment and/or drove the customer away. In comparison among the dealer groups, 27 percent of the Group 1 Automotive dealerships scored over 80, while only 12 percent of the Serra Automotive dealerships scored below 40.

When the study’s 1,739 dealerships were sorted by brand represented—including only brands with a sample size of 35 or more dealerships—the three highest scoring brands were Acura, Lexus and Toyota, all achieving a score of 64, while the three lowest scoring brands were Land Rover, Hyundai and Jeep, with scores of 47, 50 and 51 respectively. Brands whose dealers offered service appointments most quickly, in two days or less on average, were Lexus, Honda, Toyota and Acura. Brands whose customers required the longest wait for the first available service appointment were Hyundai, Land Rover and Audi, all longer than ten days on average.

Performance varied by measurement, and the following are examples of variation by dealer group average:

-

What was the elapsed time before speaking with a service advisor?

- Less than 60 seconds on average: Greenway, Berkshire Hathaway, Ganley

- More than 90 seconds on average: Group 1, Penske, Asbury, Ken Garff

-

Was the customer asked if they were experiencing any other issues?

- More than 50% of the time on average: Ken Garff, Group 1, Morgan, Herb Chambers, Hendrick

- Less than 25% of the time on average: Greenway, Napleton, Suburban

-

Was customer told how long the service would take?

- More than 40% of the time on average: Ken Garff, Ganley, Herb Chambers

- Less than 20% of the time on average: Morgan, Greenway

-

Was customer provided a cost estimate?

- More than 45% of the time on average: Ganley, Victory

- Less than 23% of the time on average: Napleton, West Herr, Morgan, AutoNation, Penske

-

Was customer offered alternative transportation?

- More than 40% of the time on average: Suburban, Group 1, Penske, West Herr

- Less than 10% of the time on average: Ganley, Greenway, Napleton

-

How many days out was the first available appointment?

- 2 days or less on average: Group 1, Greenway

- More than 7 days on average: Ken Garff, Herb Chambers, Suburban, West Herr

Since 2007 Pied Piper has applied Prospect Satisfaction Index® (PSI®) “fact-based mystery shopping” to measure how effectively dealerships for each major brand follow best practice sales process behaviors. On average, dealerships with higher PSI scores have proven to sell more vehicles to the same quantity of online or in-person sales customers. The same fact-based PSI approach has also been applied to measure behaviors that maximize service customer loyalty. An auto dealer’s relationship with a service customer typically starts with a customer phone call to schedule a service appointment. STE has been used to measure the effectiveness of those phone calls for more than ten years, but 2023 marks the first time that STE results have been compiled into an auto industry study. Pied Piper PSI industry studies of other types have been conducted annually since 2007.

About Pied Piper Management Company, LLC

Founded in 2003, Pied Piper Management Company, LLC is a Monterey, California, company that helps brands improve the omnichannel sales & service performance of their retailers, by establishing fact-based best practices, then measuring and reporting performance. Examples of other recent Pied Piper PSI studies are the 2023 PSI® Internet Lead Effectiveness® (ILE®) Auto Industry Study (Cadillac was ranked first), and the 2023 PSI® ILE® Powersports Industry Study (Polaris Inc’s Indian Motorcycle brand was ranked first). Complete PSI industry study results are provided to vehicle manufacturers and national dealer groups. Manufacturers, national dealer groups and individual dealerships also order PSI evaluations – in-person, internet or telephone – as tools to measure and improve the omnichannel sales and service effectiveness of their dealerships. For more information about the fact-based PSI process, go to www.piedpiperpsi.com.

Contacts

Pied Piper

Ryan Scott

rscott@piedpipermc.com

+1 (831) 648-1075