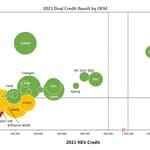

Variation Across the 2021 Dual Credit Results for Individual OEMs

BOSTON–(BUSINESS WIRE)–China’s Dual Credit policy has been in place for the past several years and has been a key driver for the rapid growth of the New Energy Vehicle (NEV) segment in China. The latest Strategy Analytics Powertrain, Body, Safety & Chassis (PBCS) and Electric Vehicles Service (EVS) report, China’s Dual Credit Policy – Winners and Losers in 2021 analyzes the 2021 dual credit results at the national and OEM (Original Equipment Manufacturer) level, finding that only 54 OEMs reached dual credit compliance. On average, Chinese OEMs delivered a much more satisfactory result than their international competitors, such as VW, GM (General Motors), Nissan, Honda, and Toyota. OEMs like Tesla and BYD with a focus on BEVs (battery electric vehicles) posted the best results.

The Dual Credit policy considers Corporate Average Fuel Consumption (CAFC) and NEV (New Energy Vehicle) credits and requires all OEMs in China to achieve positive results for both. A failure to offset deficits after adopting all compliance approaches, including buying credits from the market, leads to China’s Ministry of Industry and Information Technology (MIIT) denying approval for new model production. Strategy Analytics’ analysis of the MIIT dual credit results showed a national surplus of 10.3 million CAFC credits and 6 million NEV credits in 2021. 54 OEMs reached dual credit compliance and targets are becoming ever more stringent.

“Despite the stricter fuel consumption targets and weakened credit benefits to NEVs, the positive result of 2021 was mainly contributed by a surprisingly high NEV penetration of 15%,” noted Julia An, report author and industry analyst in the PBCS and EVS Service. “The further reduction of the NEV model score and the rise of target NEV quota, as proposed by the recently released draft policy for 2024 and 2025, shows the consistency of this regulation and is no surprise for the OEMs.”

“On average, Chinese OEMs delivered a much more satisfactory result than their international competitors, such as VW, GM, Nissan, Honda, and Toyota,” observed Asif Anwar, Director of PBCS and EVS Service. “The international players need to accelerate the implementation of their electrification strategies in China to meet stricter dual credit compliance requirements.”

Source: Strategy Analytics, Inc.

#SA_Automotive

About Strategy Analytics

Strategy Analytics, Inc. is a global leader in supporting companies across their planning lifecycle through a range of customized market research solutions. Part of TechInsights, our multi-discipline capabilities include industry research advisory services, customer insights, user experience design and innovation expertise, mobile consumer on-device tracking and business-to-business consulting competencies. With domain expertise in smart devices, connected cars, intelligent home, service providers, IoT, strategic components and media, Strategy Analytics can develop a solution to meet your specific planning need. For more information, visit us at www.strategyanalytics.com.

For more information about Strategy Analytics

Powertrain, Body, Safety & Chassis Service (PBCS)

Electric Vehicles Service (EVS)

Contacts

Report contacts:

European Contact: Asif Anwar, +44 (0)1908 423 635, aanwar@strategyanalytics.com

US Contact: Mark Fitzgerald, +1 617 614 0773, mfitzgerald@strategyanalytics.com

China Contact: Kevin Li, +86 186 0110 3697, kli@strategyanalytics.com